Be sure to check your understanding of this lesson by taking the quiz in the Test Yourself! And right at the bottom of the page, you can find more questions on the topic submitted by fellow students. For the past t accounts 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- T accounts offer simplicity and clarity in recording and analyzing transactions.

- A surprising number of people uses these handy tools, and understanding their purpose can be a game-changer for your financial literacy.

- Yes, T accounts can help detect fraud or errors in accounting records by providing a detailed trail of transactions.

- These tools offer a clear and concise way to track their finances without getting bogged down in complex spreadsheets.

- Ever stared at a page filled with capital T’s and wondered what secret language accountants were using?

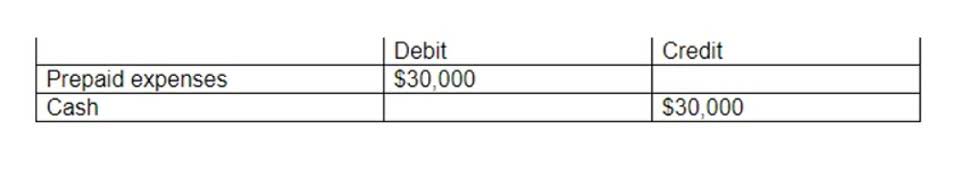

T-Account Debits and Credits

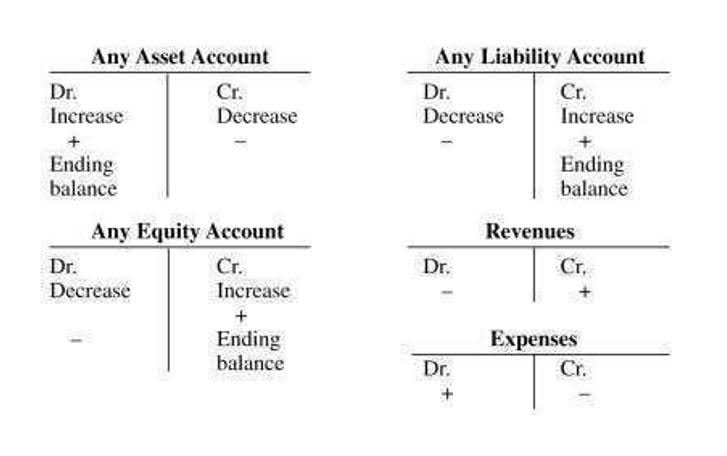

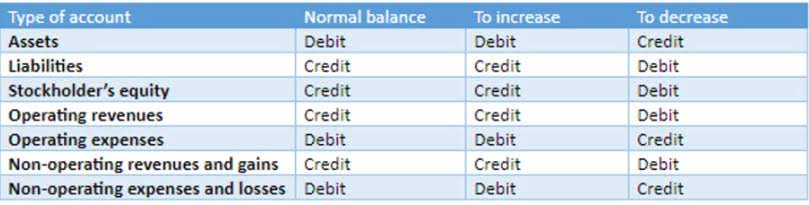

T accounts offer simplicity and clarity in recording and analyzing transactions. They provide a visual representation that helps users understand the impact of transactions on individual accounts and overall financial health. They help visualize the double-entry bookkeeping system, the core principle that governs how financial transactions are recorded. This deeper grasp empowers accountants to analyze financial data with greater confidence and interpret its implications for https://www.bookstime.com/ the business. Transactions are then recorded on the left (debit) or right (credit) side of the T, reflecting increases or decreases in that element. This visual representation helps them ensure their records’ accuracy and easily prepare financial statements.

Subsidiary Ledgers (or Sub Ledgers): Debtors Ledger and Creditors Ledger

When you earn revenue (debiting cash), you’re also using up your ability to earn that income again. Credits increase revenue because you’re recording income on account (crediting accounts what are retained earnings receivable), which hasn’t been collected as cash yet but still represents income earned. When starting out in accounting, T accounts can help you make sense of transactions in an account. It is one of the best ways to keep debits and credits straight, visually. Next we are going to build off what we have just learned and look at the normal balances of accounts in accounting. The T-account, like all accounting transactions, always keeps debits on the left side of the T and credits on the right side of the T.

Format

Now, every business has its own chart of accounts that depends on the industry they are a part of and the financial activities they lead. T accounts are used in a bookkeeping method known as double-entry bookkeeping. In this guide, we’ll be going through all the basics of T accounts, their uses in accounting, how to record them, and so much more. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- In essence, T-accounts are just a “scratch pad” for account analysis.

- No matter what type of accounting you are using, you can use a T-account as a visual aid in recording your financial transactions.

- Consider the word “double” in “double entry” standing for “debit” and “credit”.

- The source of this increase to the bank account is capital – the owner investing in the business.

- The following T-account examples provide an outline of the most common T-accounts.

Every time you contribute money, you debit (increase) the account. This way, you can easily visualize your progress and stay motivated on your savings journey. For example, stakeholders may demand financial reports in different currencies, formats, or aggregation levels to facilitate decision-making and analysis.

- Uncategorized

- Dezembro 11, 2020